First Choice Finance was established in 1988 and have always believed that talking openly to our customers about their options and ensuring they are treated with respect and in confidence throughout their journey is the best and only way to operate. Customers seeking Property equity release through a lifetime mortgage are no different and you are assured there will be no pressure to accept any offer made to you.

Alongside this you will get help, support and advice from our in house qualified equity release advisers.Equity release and other solutions can release equity for a multitude of reasons so if you have the equity available and have been looking for ways to release funds but can`t seem to get the money together from savings then we could have a solution. We will run through all the calculations and numbers with you without obligation and give you a free quotation so you can decide what to do. Fill in our shorton line enquiry form or call our equity release advisers for a confidential, no obligation talk on 0800 298 3000 from a landline or 0333 0031505 from a mobile.

Alongside this you will get help, support and advice from our in house qualified equity release advisers.Equity release and other solutions can release equity for a multitude of reasons so if you have the equity available and have been looking for ways to release funds but can`t seem to get the money together from savings then we could have a solution. We will run through all the calculations and numbers with you without obligation and give you a free quotation so you can decide what to do. Fill in our shorton line enquiry form or call our equity release advisers for a confidential, no obligation talk on 0800 298 3000 from a landline or 0333 0031505 from a mobile.What Is A Lifetime Mortgage?

As you are a homeowner already you will probably either have a traditional mortgage on your home now or will have had one in the past. As a refresher with a traditional repayment mortgage you borrow money from a lender, such as a bank or building society, to pay for your home over a set period (between 10 and 25 Years) and make payments to them through the term each month. At the end of the term the house is usually paid for and has no mortgage left on it, or if the mortgage was not fully paid back some mortgage balance may be left on it which needs to be paid of or re-arranged.This highlights a couple of key differences between traditional mortgages and lifetime mortgages. First key point in that lifetime mortgages do not usually have a fixed term. They continue to run until a specific event within your agreement occurs that triggers the mortgage balance due to be paid back.

This is usually if you die or move into full time residential / nursing care. A second key difference is that you do not have to make any repayments on lifetime mortgages until one of the specified events occurs. That being said these mortgages do incur interest charges which are added to the balance, therefore first choice now offers `interest only lifetime mortgages` where you can use some of your current income to pay back some or all of the interest on the mortgage each month to prevent the mortgage debt building and enabling you to leave more of your home to your estate (children and other beneficiaries you have decreed in your will or who will ultimately inherit your belongings). Effectively offering the best of both worlds, you get the money you would like now and the family still get some decent inheritance for later in their lives. Clearly going down the route of making payments is not compulsory, if you simply wish to enjoy spending the equity you have grown in your home without making any repayments then that is fine to.

This is usually if you die or move into full time residential / nursing care. A second key difference is that you do not have to make any repayments on lifetime mortgages until one of the specified events occurs. That being said these mortgages do incur interest charges which are added to the balance, therefore first choice now offers `interest only lifetime mortgages` where you can use some of your current income to pay back some or all of the interest on the mortgage each month to prevent the mortgage debt building and enabling you to leave more of your home to your estate (children and other beneficiaries you have decreed in your will or who will ultimately inherit your belongings). Effectively offering the best of both worlds, you get the money you would like now and the family still get some decent inheritance for later in their lives. Clearly going down the route of making payments is not compulsory, if you simply wish to enjoy spending the equity you have grown in your home without making any repayments then that is fine to.Equity From Your Home

The amount of money you can get when when you decide to release equity from your home is dependant on a number of factors. You may have a predetermined amount that you are looking for and the lender will have a maximum loan to value (LTV) they will be prepared to go to on your specific property. The relative amount owed on your home compared to the current value of it is called the loan to value (LTV). To calculate your property`s LTV or what LTV you would be at if you raise the amount you require head over to the calculators page from the top tab.

The amount of money you can get when when you decide to release equity from your home is dependant on a number of factors. You may have a predetermined amount that you are looking for and the lender will have a maximum loan to value (LTV) they will be prepared to go to on your specific property. The relative amount owed on your home compared to the current value of it is called the loan to value (LTV). To calculate your property`s LTV or what LTV you would be at if you raise the amount you require head over to the calculators page from the top tab.As an example;

- if you still have £15,000 left owed to your mortgage company and your house was worth £120,000 the loan to value you are at is 15,000 / 120,000 X 100 = 12.5%.

Equity Release Scheme

The money raised through an equity release scheme can be used for virually any, legal, purpose. Also unlike many standard repayment mortgage and remortgage schemes your credit your credit history has little or no bearing on whether you will be accepted. Even if you have County Court Judgements, Mortgage arrears, missed loan or credit card payments or even defaults we can still help you raise money through equity release. There are two initial boxes you need to tick to be able to start the ball rollingYour house needs to be capable of being sold, which is fair enough as that is the only time the lender is going to get their capital back, and you have to be at least 55 years old to be eligible.

To Recap :-

- There is usually no minimum term on a lifetime mortgage

- Interest rolls up at the applicable lifetime mortgage rates

- Rolled up interest is added to the mortgage balance and so the debt grows

- First Choice Finance only sources equity release schemes with a no negative equity guarantee. This means that even though the interest is added on to your mortgage balance you can not owe more when the house is sold than you owe on it.

- We also offer interest only lifetime mortgages where you can pay all or some of the interest of as you go, thereby reducing the amount of mortgage due and improving the amount left to your beneficiaries on your death

- Your house must be capable of being sold and you must be at least 55 years old.

- Your credit history is pretty much irrelevant to you being accepted, even if it is very poor

- You can spend the money as you wish; supporting loved ones, a world cruise, major home renovations, a holiday home, debt consolidation, landscape gardening, disability vehicle or a new car to tour around in – the choice is yours.

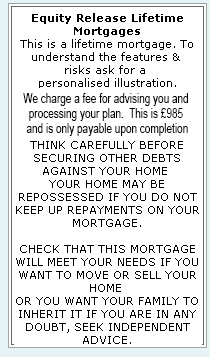

Equity Release Lifetime Mortgages |

Late repayment can cause you serious money problems. For help, go to moneyhelper.org.uk

Established In 1988. Company Registration Number 2316399. Authorised & Regulated By The Financial Conduct Authority (FCA). Firm Reference Number 302981. Mortgages & Homeowner Secured Loans Are Secured On Your Home. We Advice Upon & Arrange Mortgages & Loans. We Are Not A Lender.

First Choice Finance is a trading style of First Choice Funding Limited of 54, Wybersley Road, High Lane, Stockport, SK6 8HB. Copyright protected.

Every Quote Is Free & Confidential

Every Quote Is Free & Confidential